In late 2020 we reported that stevedores in Australia had implemented procedures to check the weight of shipping containers, imposing a penalty when they identified discrepancies of plus or minus one tonne (+/- 1t) between the actual and declared weights. They have the authority to do this under the Australian Maritime Safety Authority (AMSA), the […]

News

Trade Potential with Brazil

Austrade yesterday issued a release titled Insight – Brazil reduces tariffs on over 6,000 goods. They advise that the Executive Committee of the Brazilian Foreign Trade Chamber (GECEX) has issued Resolution No. 353 reducing tariffs on 6,190 products arriving there from 01 June 2022. Reductions will be in place for 18 months until 31 December […]

The Hazards of Shipping Lithium Batteries

The recent fire aboard the car carrier vessel Felicity Ace in the Atlantic (pictured above) focused all the stakeholders in the auto shipping industry on the issue of what to do about electric vehicles (EVs) that spontaneously combust while being transported at sea. The cars on the ship burned with such intensity that parts of […]

Pallet Shortage: The Next Jolt to the Supply Chain

A whole host of issues, including natural disasters, the Covid pandemic and the conflict in Ukraine, have combined into a “perfect storm” that has created a shortage of shipping pallets, both nationally and worldwide. Recently we have been reporting on the various obstacles facing the global supply chain such as the Covid lockdowns in China […]

Freight Data Hub is Established

Australian freight data has taken a leap forward with the launch of the National Freight Data Hub prototype website. The Australian Government announced $16.5 million of funding in the 2021-22 Budget over four years to develop the Hub further. In an announcement this week, Deputy Prime Minister Michael McCormack said the Hub will be a trusted source of freight data for […]

The Responsibilities of Shippers & Consignees

The Australian Border Force (ABF) has issued its first Australian Customs Notice (ACN) for 2021. It is numbered 2021/01 with the title: Definition of ‘consignment’ for the purposes of section 68 of the Customs Act 1901. (It is to be noted that this advice supersedes ACN 2006/59). Importers are advised that they should take steps […]

New Push to Halt Imports Made by Slavery

Almost 25 million people in the Asia-Pacific Region alone are estimated to be enslaved in global supply chains.  Credit: Bloomberg Australia’s world-leading attempts to tackle modern slavery around the globe will be empowered with a $10.6 million national action plan which was funded in the last budget. The funding is also designed to help equip […]

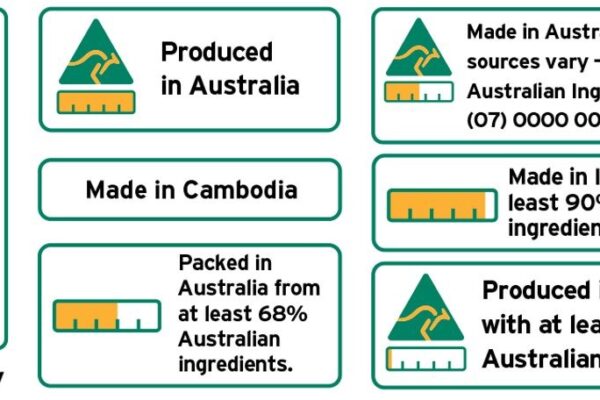

Importers Must Comply with Origin Rules

Ruling by the ACCC Consumer watchdog the Australian Competition and Consumer Commission (ACCC) has carried out compliance checks across a range of frozen fish products, becoming concerned the products displayed a misleading ‘Made in Australia’ mark. Popular fish brands like Birds Eye, I&J and Neptune will no longer be sold as being ‘Made in Australia’ […]

Colless Young Celebrates 40 Years of Service!

The origins of our company were established in October 1980, when the founders, Derek Colless and Paul Young, commenced trading from a one-room office in the suburbs of Brisbane as Colless Young & Co. The pair had previously worked together for two multi-national forwarders during the 1970s, which had been an exciting decade for the […]

Exchange Rate for Customs Purposes

For Customs purposes, when importing cargo into Australia, the Valuation Date for applying the rate of exchange on the import entry has long been subject to finding out the date at the place of export. Where goods are packed in a container, the day of exportation is the day the container leaves the place where […]