Tariff Concession Orders (TCOs) are an Australian Government revenue concession that exists where there are no known Australian manufacturers of goods that are substitutable for imported goods.

The Tariff Concession System is designed to assist manufacturers with tariff protection. It is administered by the Australian Border Force (ABF). Many domestic manufacturers use a mix of imported and Australian content in their products and therefore might be able to claim concessions on some imported content. Duty Drawback Schemes allow duty to be reclaimed by Australian manufacturers who use imported content in their products if they are later exported.

In order to claim a TCO in accordance with the Australian law, your imported goods must:

– firstly be classifiable to the tariff classification to which the TCO is keyed; AND

– precisely meet the description given to the TCO.

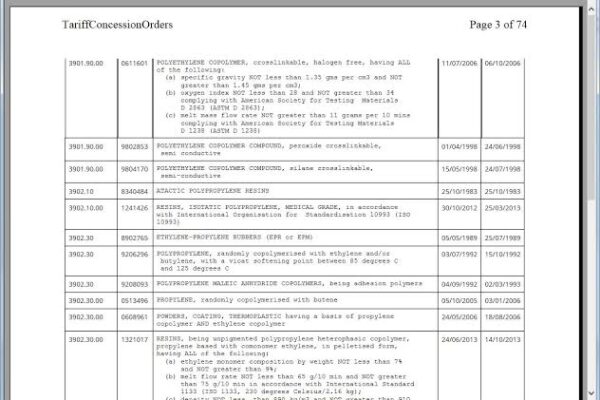

There are 15,000 existing TCOs and at least 50 new TCOs are made each month. When a new TCO is made, it is published in the Commonwealth of Australia Tariff Concessions Gazette (the Gazette), which gives legal effect to the creation of a number of instruments such as By-Laws, TCOs, TCO Revocations and Determinations.

If you import goods, and claim a revenue concession through a TCO, you need to be aware that penalties may apply if your goods do not precisely match the TCO description and/or its tariff classification.

You are entitled to object to a TCO if it adversely affects you. If you object to the making of a TCO or seek to revoke an existing TCO, you need to demonstrate your goods have a corresponding use to the imported goods. Objectors to the making of a TCO are not identified unless the objection is successful.

The Gazette is published by the ABF each Wednesday and is received by us here at Colless Young. Â As your licensed Customs Brokers and International freight forwarders, we can give you professional guidance on TCOs and all your import requirements.