From 01 January 2020 there will be changes to approved imports and manufacture of HCFC gas and HCFC equipment. The Australian Border Force (ABF) has issued Australian Customs Notice No. 2019/40 concerning the issue: “Changes to import licence requirements for equipment containing hydrochlorofluorocarbon (HCFC) refrigerant.â€

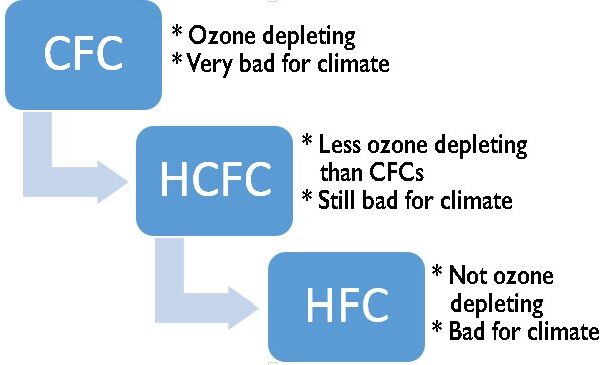

Importing or manufacturing all types of HCFC equipment (including, for example, HCFC aerosols and HCFC fire protection equipment) will be banned, except in certain circumstances where a licence may be granted by the Department of the Environment and Energy (DoEE). This applies to equipment that uses HCFCs, even if it does not have gas in it at the time of import.

These changes will have no impact on the import of equipment containing synthetic greenhouse gases such as HFCs.

Personal and household goods import licence exemption

Importers are able to import HCFC equipment without holding a licence if they meet the requirements for the personal and household goods exemption: Importers must have owned the equipment for 12 months before the import, and it is wholly or principally for private or domestic use.

Low volume import exemption conditions

An equipment licence (EQPL) is not required if you are importing no more than five pieces of HCFC equipment containing less than 10 kilograms in total of HCFC in a single shipping consignment. This low volume import exemption can only be used once in a two-year period.

As your licensed Customs Brokers and International freight forwarders, Colless Young can advise you on the rules and regulations applicable to your imports across all government departments. Call us to discuss your international trade and shipping activities, import or export. We cover all Australian ports and airports.