Three issues have dominated shipping news over the past three years: The Pandemic; Supply Chain Crisis; Shortage of Shipping Containers. There was some hope that Roll-on/Roll-off vessels, or Ro-Ro, would help alleviate some of these supply-chain issues. However the surge in demand for that mode of shipping has meant we are now encountering difficulty securing Ro-Ro space too.

Major Ro-Ro operators, including NYK, Wallenius Wilhelmsen and Hoegh, have found that the increased demand has resulted in a worldwide shortage of Ro-Ro space over the past couple of months – with a corresponding increase in freight rates.

For vehicle carriers, Ro-Ro is the cheapest method for sending cars over long trans-global distances when available. It is perfect when time is not a critical factor and when it suits the sender to unload the cargo in one of the specialist port facilities that handle these vessels.

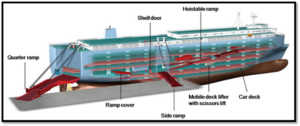

Specialist ocean-going vessels known as PCC (Pure Car Carrier) and PCTC (Pure Car & Truck Carrier) have a far higher capacity and this economy of scale and their specialist design deliver cost efficiencies for bulk transport. Decks are designed around efficient loading and unloading and are height-adjustable to maximise the inboard cargo space utilisation.

Some cargo, such as heavy mining equipment and agricultural machinery, simply will not fit inside containers. Cars, on the other hand, can usually be shipped by either mode. There are shipping containers specifically designed to move vehicles that offer slots for three or four vehicles, depending on their size, having ramps inside for double- or diagonal-stacking.

Insufficient PCTC space is driving some Chinese auto-makers to use containers to export their vehicles instead of Ro-Ro. Rates for containerised shipping have come down from the historical peaks of last year, while prices for space on Ro-Ro car-carriers have soared.

Movement restrictions imposed during the early wave of the Covid-19 pandemic slashed demand for cars, which saw some older PCTC vessels being scrapped, and there was a disinclination by shipping lines to build new ships. As pre-pandemic lifestyles resume, demand for vehicles is recovering, in turn causing a PCTC shortage. One noticeable effect is that the space being allocated to used cars is decreasing.

One of the largest Ro-Ro operators, Wallenius Wilhelmsen, has issued a statement online saying that all Australian Ro-Ro terminals are facing unprecedented congestion challenges. They add, “The impact is now manifesting in terms of vessel delays and service disruptions. In January 2023, 117 days were lost to terminal congestion in Oceania, more than double the amount experienced in December 2022, which was already at record levels.” Wallenius Wilhelmsen said that although some 43 of its fleet of 130 ships were built between 1983 and 1997, it has decided to suspend plans to order more vessels.

While we always do our best to handle consignments for our clients in their preferred manner, we would like shippers to be aware of the changing trends, and current indications are that space will get tighter on Ro-Ro vessels before it gets better.

In the case of vehicles, we will be happy to discuss the options of containerised versus Ro-Ro so you can take cost, timeframe and security issues into consideration.

Colless Young should be your first stop for shipping cars, trucks and motorcycles. If you are buying a second-hand vehicle make sure you contact us prior to shipping so that we can help you make all the necessary arrangements in advance.

We offer shipping by Airfreight, Roll-On Roll-Off vessels and Containerised seafreight movements. Our complete range of logistics services cover import and export cargo, both air and sea, through all Australian ports and airports.